In addition, before trading, users are required to verify their accounts. Additionally, the user must enter their address and source of funds.

GEMINI EARN REVIEW FULL

A customer's full name, email address, and password are required for the initial sign-up.

GEMINI EARN REVIEW REGISTRATION

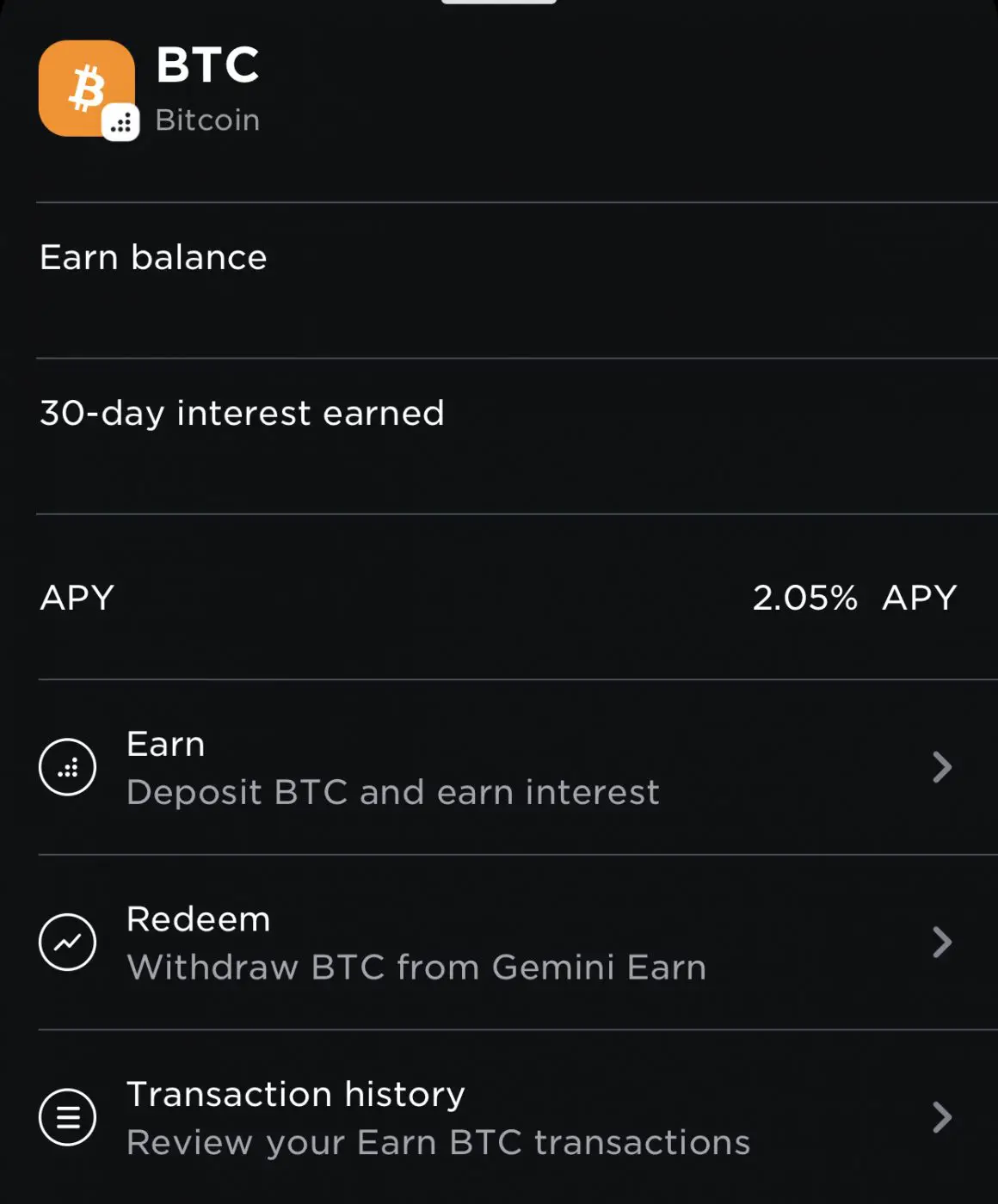

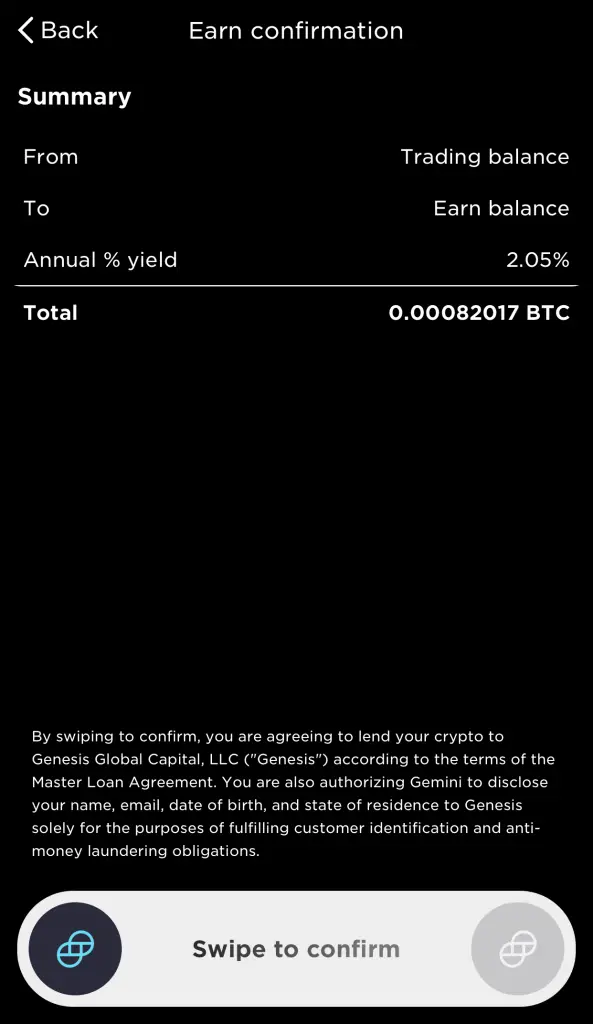

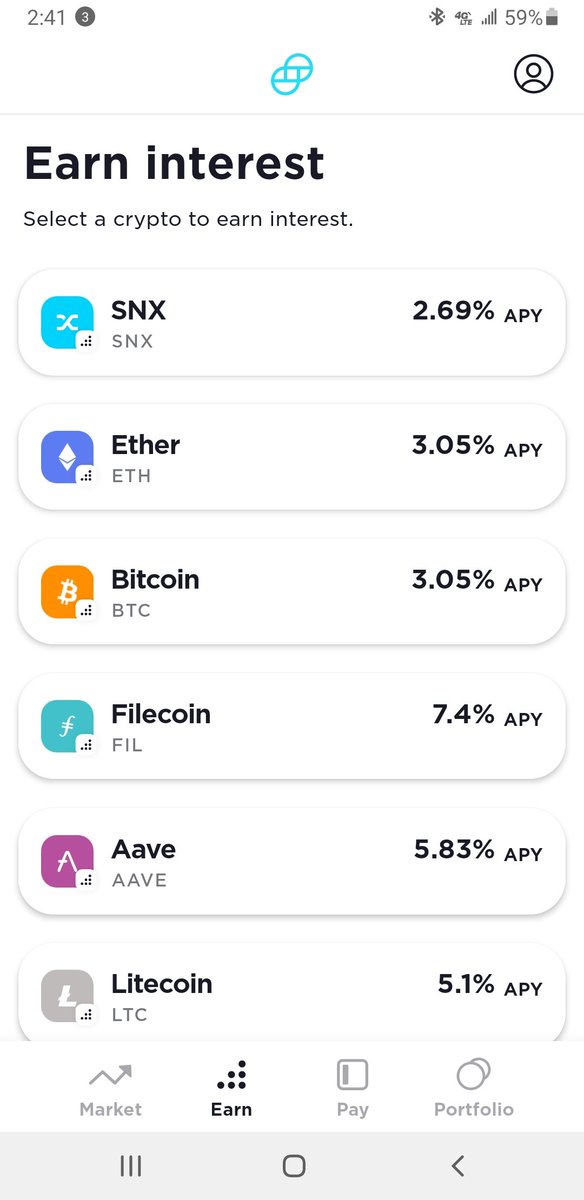

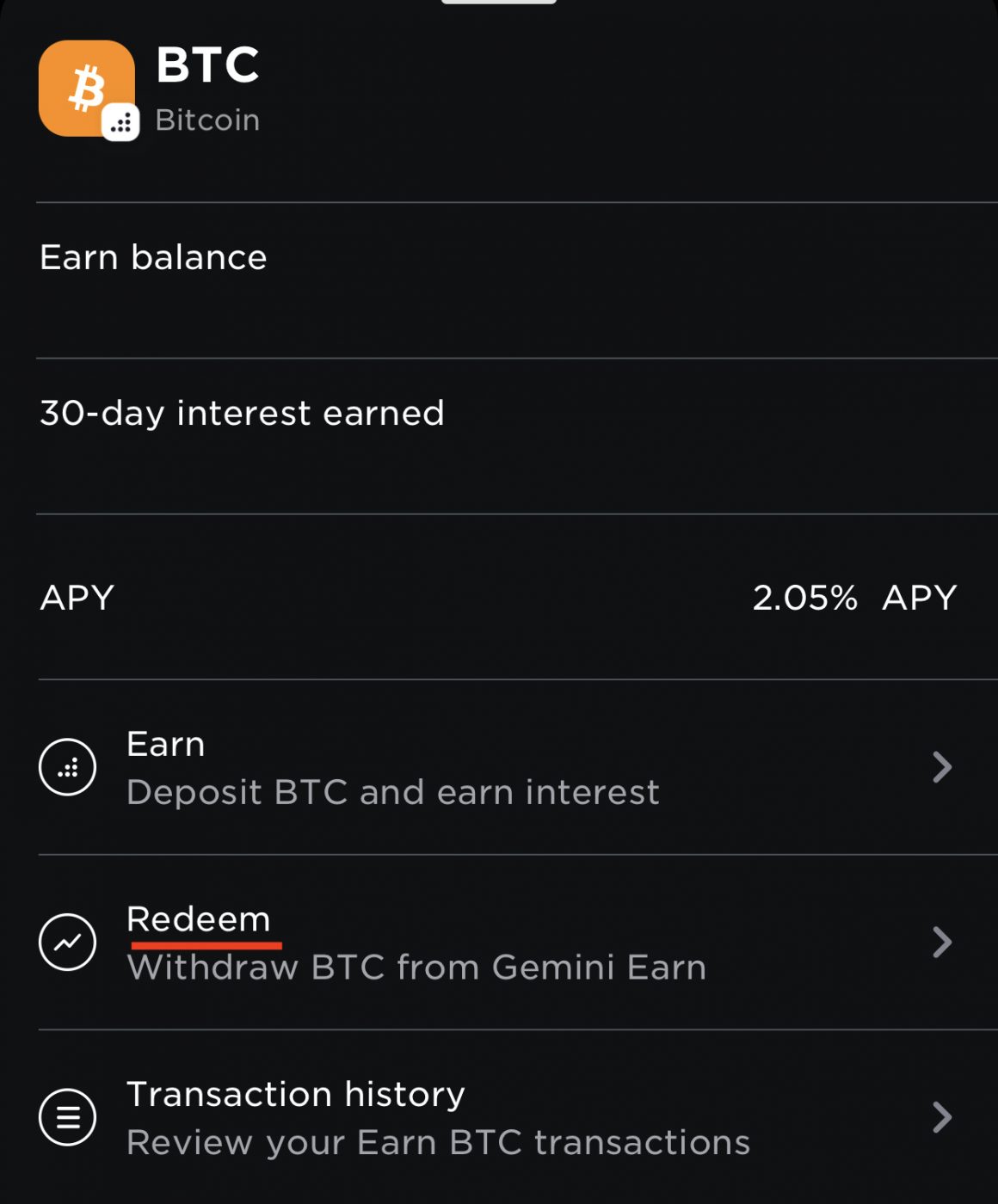

Users must go through the registration process to create an account with Gemini. To learn more, read our guide on GUSD, which explains how it works and its uses within and outside of the Gemini ecosystem. In addition, there are no fees to purchase GUSD on the Gemini platform. The price of GUSD is pegged to the US Dollar and is one of the only insured stablecoins on the market.Īs an ERC-20 token, GUSD can be used on Ethereum-based DeFi applications and held in any ERC-20 compatible wallet. This coin can be used for trading on the Gemini exchange and is also available on other platforms. Gemini offers a stablecoin known as Gemini Dollar (GUSD). Partnered with top companies Samsung, Tradingview, Brave, and Nifty Gateway, Gemini is an exchange and custodian that provides a simple, elegant, and easy way for individuals and institutions to buy, trade, store, and sell digital assets. Gemini is a private New York trust company founded in 2014 by Cameron and Tyler Winklevoss, commonly known as the "Winklevoss twins." The company provides a legitimate cryptocurrency exchange licensed and regulated by the New York State Department of Financial Services (NYSDFS). Gemini Earn was a high-yield investment service offered by the exchange, with Genesis serving as a primary lending partner before freezing withdrawals in November 2022.Įarlier this year, Gemini threatened legal action against both DCG and its CEO, Barry Silbert, if no plans were presented to repay Gemini’s $900 million loan to the crypto lender.Įarlier in the month, the crypto lender Gemini filed a case against DCG, claiming the payment was in default.Gemini Credit Card, Gemini Wallet, Gemini Custody, Gemini Dollar (GUSD)īTC, ETH, SOL, DOGE, MATIC, LINK, & 110 others Gemini Threatens Legal Action Over Frozen Withdrawals and Loan RepaymentĪccording to Gemini, Genesis has refused to return funds to approximately 232,000 users who participated in the Gemini Earn program and had active loans as of January 19, 2023. In addition, the Gemini is preparing “the Gemini Master Claim.” The plan seeks to recover over $1.1 billion worth of cryptocurrencies that it believes Genesis owes. On the other hand, Gemini will have until October 26 to accept it. If approved, Genesis will have until August 27 to file the reorganization plan.

The court filing stated that the extension aims to prevent the disruption caused by introducing a competing plan.

The purpose of this extension is to allow more time for the involved parties to navigate the bankruptcy proceedings and facilitate the ongoing efforts to achieve a restructuring that maximizes value. The lender must consider the ever-evolving regulatory landscape in its case. The lender revealed significant assets and liabilities on its balance sheets that would undergo restructuring.Īdditionally, Genesis pointed out that its involvement in the digital asset industry adds another layer of complexity to its proceedings. Genesis emphasized the size and complexity of its case as grounds for the court to grant the extension.

The lender stated that the extension was necessary to ensure a restructuring process that maximizes value and avoids disruption from competing plans. In a recent court filing, bankrupt lender Genesis requested an extension from the United States Bankruptcy Court for the Southern District of New York. A spokesperson from DCG mentioned that they are actively engaged with stakeholders in the Genesis Capital restructuring process during the 30-day mediation period starting May 1. If no resolution is reached, the crypto exchange is considering presenting an independent “amended plan of reorganization” without DCG’s consent. The decision to grant forbearance will partly depend on whether all parties believe DCG will negotiate in good faith for a consensual deal.

GEMINI EARN REVIEW UPDATE

In an update on its website, the exchange led by the Winklevoss twins said it is currently evaluating the option of granting forbearance to DCG, along with creditor committees, to prevent a default. Gemini issued a warning recently, expressing concern that DCG might default on its obligations if it doesn’t make the required payment or restructure its debt.

Firm Warns of Potential Default by DCG and Considers Forbearance Options Genesis is currently undergoing bankruptcy proceedings. The payment in question relates to a loan provided by Gemini to Genesis, a crypto-lending subsidiary of DCG. Gemini has raised concerns over DCG’s failure to honor the $630 million payment obligation. Join Our Telegram channel to stay up to date on breaking news coverage

0 kommentar(er)

0 kommentar(er)